Comparing the Best Secured Credit Card Singapore Options for 2024

Wiki Article

Exploring Options: Can Former Bankrupts Secure Credit History Cards Adhering To Discharge?

One usual question that develops is whether former bankrupts can successfully acquire debt cards after their discharge. The response to this inquiry involves a complex expedition of various elements, from credit history card alternatives customized to this group to the influence of previous financial choices on future creditworthiness.Recognizing Credit Rating Card Options

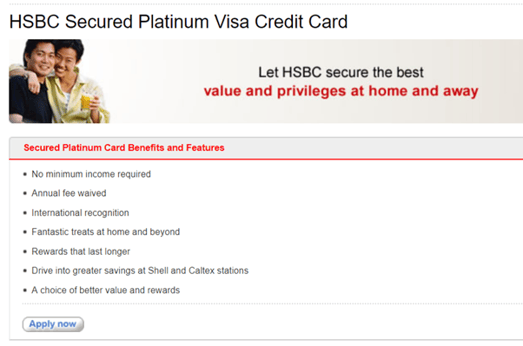

When taking into consideration credit scores cards post-bankruptcy, individuals have to thoroughly evaluate their demands and financial situation to pick the most appropriate option. Protected credit score cards, for circumstances, need a money deposit as security, making them a feasible selection for those looking to rebuild their credit rating background.Moreover, individuals must pay close attention to the annual percent rate (APR), moratorium, yearly charges, and incentives programs offered by various bank card. APR determines the cost of borrowing if the equilibrium is not paid in complete every month, while the moratorium figures out the window during which one can pay the equilibrium without incurring interest. Furthermore, annual charges can influence the general cost of possessing a credit history card, so it is vital to evaluate whether the advantages exceed the charges. By thoroughly examining these factors, people can make enlightened choices when choosing a bank card that lines up with their economic objectives and situations.

Aspects Affecting Approval

When requesting charge card post-bankruptcy, comprehending the elements that impact authorization is vital for people looking for to restore their monetary standing. One crucial aspect is the candidate's credit rating. Adhering to an insolvency, credit scores usually take a hit, making it more challenging to qualify for traditional charge card. Nevertheless, some issuers supply protected credit rating cards that call for a deposit, which can be an extra achievable choice post-bankruptcy. Another significant factor is the candidate's income and employment status. Lenders wish to guarantee that people have a stable income to make timely payments. Furthermore, the length of time because the insolvency discharge contributes in approval. The longer the duration since the bankruptcy, the higher the possibilities of approval. Demonstrating accountable economic actions post-bankruptcy, such as paying costs in a timely manner and keeping credit rating usage low, can likewise positively influence credit history card approval. Recognizing these elements and taking steps to improve them can enhance the possibility of safeguarding a credit history card post-bankruptcy.

Safe Vs. Unsecured Cards

Protected credit cards require a money down payment as security, usually equivalent to the credit score limit expanded by the company. These cards usually offer greater credit scores limits and lower rate of interest rates for individuals with excellent credit rating scores. Eventually, the option in between secured and unsecured credit scores cards depends on the person's economic circumstance and credit report objectives.

Building Credit Report Sensibly

To efficiently reconstruct credit post-bankruptcy, establishing a pattern of responsible credit rating application is crucial. In addition, keeping credit score card equilibriums low loved one to the credit history restriction can favorably influence credit score scores.An additional strategy for constructing credit responsibly is to keep an eye on credit report reports regularly. By evaluating credit rating records for errors or signs of identification burglary, people can address issues promptly and maintain the precision of their credit background. Visit Your URL Furthermore, it is advisable to avoid opening up numerous new accounts at the same time, as this can signify monetary instability to potential lending institutions. Rather, concentrate on slowly diversifying charge account and demonstrating consistent, accountable credit score habits over time. By adhering to these techniques, individuals can slowly rebuild their credit score post-bankruptcy and job in the direction of a healthier financial future.

Reaping Long-Term Benefits

Having established a foundation of liable debt monitoring post-bankruptcy, people can currently focus on leveraging their boosted creditworthiness for long-lasting monetary advantages. By constantly making on-time payments, maintaining credit scores utilization low, and checking their credit history records for precision, former bankrupts can progressively restore their credit rating. As their credit history increase, they might become eligible for far better bank card supplies with reduced rate of interest and greater credit report restrictions.

Gaining long-term benefits from boosted creditworthiness prolongs beyond simply credit cards. Additionally, a favorable credit score profile can improve task leads, as some employers may inspect credit scores records as component of the working with procedure.

Conclusion

Finally, previous insolvent people might have difficulty safeguarding credit cards following discharge, but there are options available to aid rebuild credit Related Site history. Understanding the various sorts of bank card, aspects affecting authorization, and the relevance of responsible credit report card usage can help people in this circumstance. By picking the best card and utilizing it properly, former bankrupts can progressively useful reference boost their credit rating and reap the lasting advantages of having access to credit rating.

Showing accountable financial actions post-bankruptcy, such as paying bills on time and keeping credit scores usage low, can also favorably affect credit rating card approval. Additionally, keeping credit report card balances reduced relative to the credit scores limitation can positively affect credit history ratings. By continually making on-time repayments, maintaining credit report application low, and checking their credit scores records for precision, previous bankrupts can progressively rebuild their debt ratings. As their credit score ratings boost, they might come to be eligible for far better credit scores card supplies with lower rate of interest rates and higher credit score restrictions.

Understanding the various types of credit cards, elements affecting approval, and the importance of responsible credit card usage can help people in this circumstance. secured credit card singapore.

Report this wiki page